What is 2290 Schedule 1 and why it matters for vehicle registration

What is 2290 Schedule 1 and why it matters for vehicle registration

Blog Article

April 15 is the tax filing deadline for 2009. This means you need to have your tax return in the mail by the end of that day. If you do not have your return in the mail by that time, you're technically late in the filing of said return which of course will not make the IRS happy.

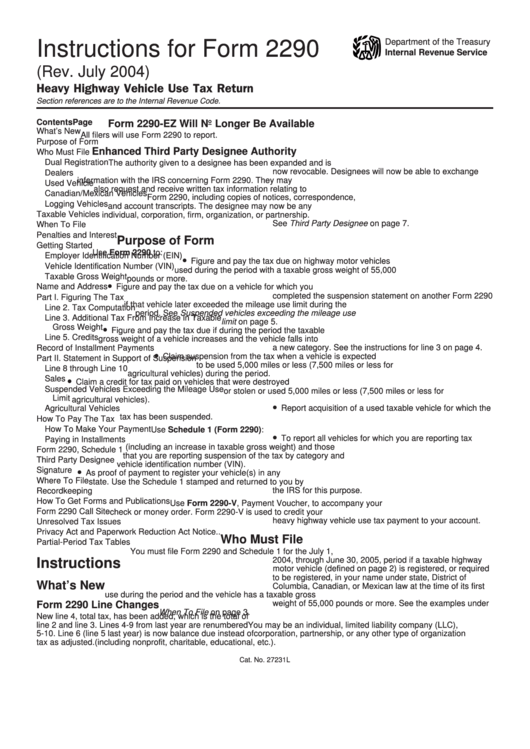

Owners and operators of buses, tractor trailers, and rigs all agree that electronically filing helps you to focus more on time on the road than paperwork. Now you can get proof of paying these 2290 tax form right in your email box. When tax assessment time comes around on July 1st be ready to take advantage of this easy filing option. Also remember that no matter when the truck was purchased, for the upcoming tax year the due date to file is August 31st unless noted otherwise by the IRS.

Next is the income section which for most people consists of wages and possibly interest income. Other Form 2290 online of income that are common are rental income, IRA or pension distributions, dividends, and unemployment. Also, if you itemize your state refund is taxable and if you have any business income. Business income requires filing a Schedule C., so you'll have to figure out the income and expenses for the business separately and enter them on Schedule C. Wages are reported to you on a IRS Form 2290 W2 and a lot of the other types of income are reported on 1099's so watch for these in the mail. W2's are due to you by the end of January and 1099's should be mailed by the end of February.

Online and phone order transcripts usually arrive within 5 to 10 days of the IRS's receipt of your request. Mail-ordered transcripts can take up to 30 days.

If you need an actual copy (rather than a transcript) of a previous tax return, you will need to pay $57 for each tax year requested. Fill out Form 4506 and send it to the IRS heavy vehicle tax address on the form. You can usually obtain a copy from the current year and the past six years. The copies can take up to 60 days to arrive. Making it a little challenging to complete your 2011 taxes without an extension.

The United States has the highest incidence of tornadoes worldwide with more than 1000 per year. They can come in clusters, or one at a time. Touch down can be seconds, or as long as an hour; leaving a path from 50 yards to 1 mile, and traveling at speeds from 30 - 70 mph..

Anytime you can itemize you can save more money on income taxes so speak to your NYS CPA or tax consultant in New York to find out how you can itemize. Report this page